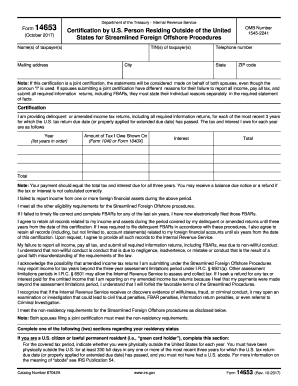

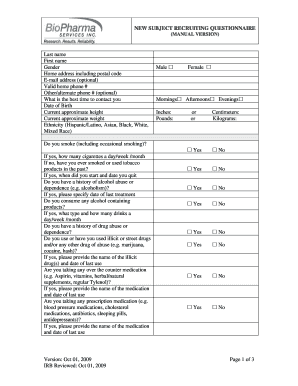

IRS 14653 2025 free printable template

Get, Create, Make and Sign irs form 14653

How to edit form 14653 online

IRS 14653 Form Versions

How to fill out irs form 14654

How to fill out form 14653

Who needs form 14653?

Video instructions and help with filling out and completing form 14653

Instructions and Help about form 14653 download

This is tax attorney Prague Patel here to talk to you about form 14653 certification for U.S. persons residing outside the United States for the streamlined foreign offshore procedure program this particular form is available at the IRS website, and it's be to be used specifically for this program for people that live outside the United States this form is only three pages long, but it is loaded with legal you know terminology I wanted to just quickly explain to you the importance of this form what happens with this form and some details first this form is to be filled out by the taxpayer and to be sent in to the IRS there's a specific office at the IRS that processes these forms it's in Austin Texas it's not a large processing facility it only receives these particular filings and the examiners are well versed with uh these filings because that's all they see uh just from our office alone we've filed hundreds of these filings over the years and um you know we've had great success with this program uh particularly when taxpayers live outside the United States when you've let's live...

What is form 14653?

People Also Ask about irs form 14653 pdf

What do I write on Form 14653?

How do I file a streamlined procedure?

How do I file a streamlined procedure?

What are streamlined taxes?

How long does the streamline process take?

What is the IRS amnesty program for expats?

What is streamlined reporting?

What is IRS Form 14653?

Who is eligible for streamlined foreign offshore?

What is the IRS streamlined program?

Is there an IRS amnesty program?

How long does it take IRS to process streamlined procedure?

How long does it take IRS to process streamlined?

What is the penalty for IRS streamlined procedure?

How much will the IRS usually settle for?

What is IRS streamlined procedure?

How do I file streamlined?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify the fillable form 14653 without leaving Google Drive?

How do I make edits in the fillable form 14653 without leaving Chrome?

Can I edit the fillable form 14653 on an iOS device?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.